Did a friend recommend VeraCash® to you? Or did you find us on Google? If you’re about to open a VeraCash® account because you find our service original and unique, go for it!

VeraCash is now available in most countries in the European Economic Area (EEA), so we wanted to give you some more information about the different steps involved in opening an account. And for our existing members, this is why we often ask you for information.

Before we can confirm your registration, we need to be able to trust you as much as you trust us. And this is where KYC (Know Your Customer) and KYB (Know Your Business) come into play. If you are already a customer, you have necessarily gone through the KYC procedure.

What is KYC?

VeraCash® is an official agent of a financial institution called Prepaid Financial Services (PFS), which allows us to issue a Mastercard payment card. As its agent, we need to verify that you are indeed the person you claim to be. Now, we are not insinuating that you have any reason to conceal your identity, but some people do have excuses for doing so. We’ll circle back to that later…

So, VeraCash asks for a legible copy of your official identification, proof of your address and your bank details: this is the part of the iceberg that is hidden under the water. Without going into too much detail, we have algorithms that check each document to ensure it hasn’t been stolen or falsified and that apply a number of fraud prevention rules. And we’re sorry to say that we receive forged documents every week.

Who does KYC concern?

These regulations only concerned banks and insurance companies originally, but the financial sector is continually evolving. European Payment Services Directives PSD1 and PSD2 are allowing a new type of player—fintechs (financial technology companies)—to modernise payment services. Today, fintech companies (like VeraCash®) and many other businesses(1) are considered to be financiers in their own right, so all changes to financial regulations, including AML/CFT (anti-money laundering and combating the financing of terrorism), concern them too.

Why is KYC necessary?

Quite simply because it is a legal obligation. At present, Directive (EU) 2015/849 regulates the European financial system and has done since it came into force in June 2017.

The FCA (Financial Conduct Authority), which regulates financial activities in The United Kingdom, and the ACPR, in France, ensure that these directives are followed by all financial players.

The ACPR recently asked our e-banking partner PFS to conform to certain new developments in AML/CFT legislation. As a result of the domino effect, PFS, in turn, asked us to add some extra verifications to our KYC procedure.

By extension – and most importantly – KYC allows us to offer a safe service to all our users, by excluding fraudsters, money launderers, terrorists and so on. As a customer of our platform, you are also protected against identity theft and attempts to hack into your account. With these goals in mind, we have sometimes had to apply stricter conditions at certain times to improve security for our members’ accounts and to guarantee the integrity of our system as a whole.

If VeraCash were to permit the financing of illegal activities, such as anonymous arms purchases for terrorists and money laundering, with complete impunity, all of our customers would eventually be negatively affected. Yes, we know those cases may seem a little extreme, but they are nonetheless a reality in today’s financial climate. Why do you think hackers demand payment in Bitcoin when they attack companies with ransomware(2)? The answer is simple: because it protects their anonymity.

[Spoiler Alert] The true story of a bank that voluntarily foregoes KYC!

Netflix has a docuseries called Dirty Money. One of its episodes is devoted to HSBC, which became the preferred financial institution of Mexican drug cartels a few years back, simply because there was no KYC process involved in opening an account.

The bank is accused of having laundered hundreds of millions of dollars for the Sinaloa Cartel (USD 800 million in total) and of being indirectly responsible for the deaths of more than 10,000 Mexicans.

The bank avoided prosecution by paying a fine of USD 1.9 billion, negotiated with the US Department of Justice in return for dropping the charges… equivalent to just five weeks of their net profit.

What are the KYC and KYB procedures in effect at VeraCash?

In a perfect world, we’d be delighted to just ask you for an email address when you open an account. Alas, there is no perfect world. Rest assured, we have as little red tape as possible, while still following the law and guaranteeing maximum security for your personal account.

This means that you will need to go through our verification procedures if you want to create a free account:

For a personal account:

- Provide these three documents:

- A copy of your valid official ID;

- Proof of your address, dated within the last three months;

- Bank details.

- Complete your profile.

For a youth account:

The same as for a personal account, plus:

- Proof of parentage;

- A letter of authorisation signed by your legal guardian.

For a business account (KYB):

The same as for a personal account, plus:

- The company’s deed of incorporation;

- The company by-laws.

Some of you may be surprised to be asked for supporting documentation when topping up your VeraCash® account. Anti-money laundering rules apply here, so proof of the source of your funds will be required in the following instances:

- All top-ups of more than EUR 20,000.

- All top-ups for accounts with a balance of over EUR 20,000.

Is my information secure?

Even before implementation of the GDPR, keeping your information secure was already a priority for us: our servers are encrypted (SSL and TLS 1.2) and are audited on a regular basis by information systems security professionals.

Obviously we do not sell your personal information to any other business organisation. It will remain exclusively in the custody of VeraCash® and our e-banking partner PFS. Only the authorities will be able to access it if it is required for criminal proceedings, which is extremely rare.

Now you know everything!

At this point, we hope we have reassured you that VeraCash is taking every measure to provide a sound, secure environment for all. For the majority of people, who have done nothing wrong—and we have no doubt that you are among them—registration is completely free, with no subscription fees.

But if you still have any questions, we are at your disposal via chat, email, phone or Facebook… In short, wherever you choose to look for us! ?

(1) Many types of businesses are now eligible to AML/CFT efforts, including insurance companies and brokers, provident institutions, supplementary health insurers, insurance, reinsurance and capitalization associations, chartered accountants and employees authorized to exercise the profession of chartered accountant, lawyers, solicitors before courts of appeal, notaries, process servers and more.

(2) According to software vendor Kaspersky, “Ransomware is malicious software that infects your computer and displays messages demanding a fee to be paid in order for your system to work again. This class of malware is a criminal moneymaking scheme that can be installed through deceptive links in an email message, instant message or website. It has the ability to lock a computer screen or encrypt important, predetermined files with a password.”

Nicolas Faucon

Nicolas has been an inbound and digital marketing specialist for almost 10 years and is currently, the Marketing and Communication Manager for the AuCOFFRE group. He has been supporting the growth of VeraCash since 2016.

You might be interested in

11 May 2023

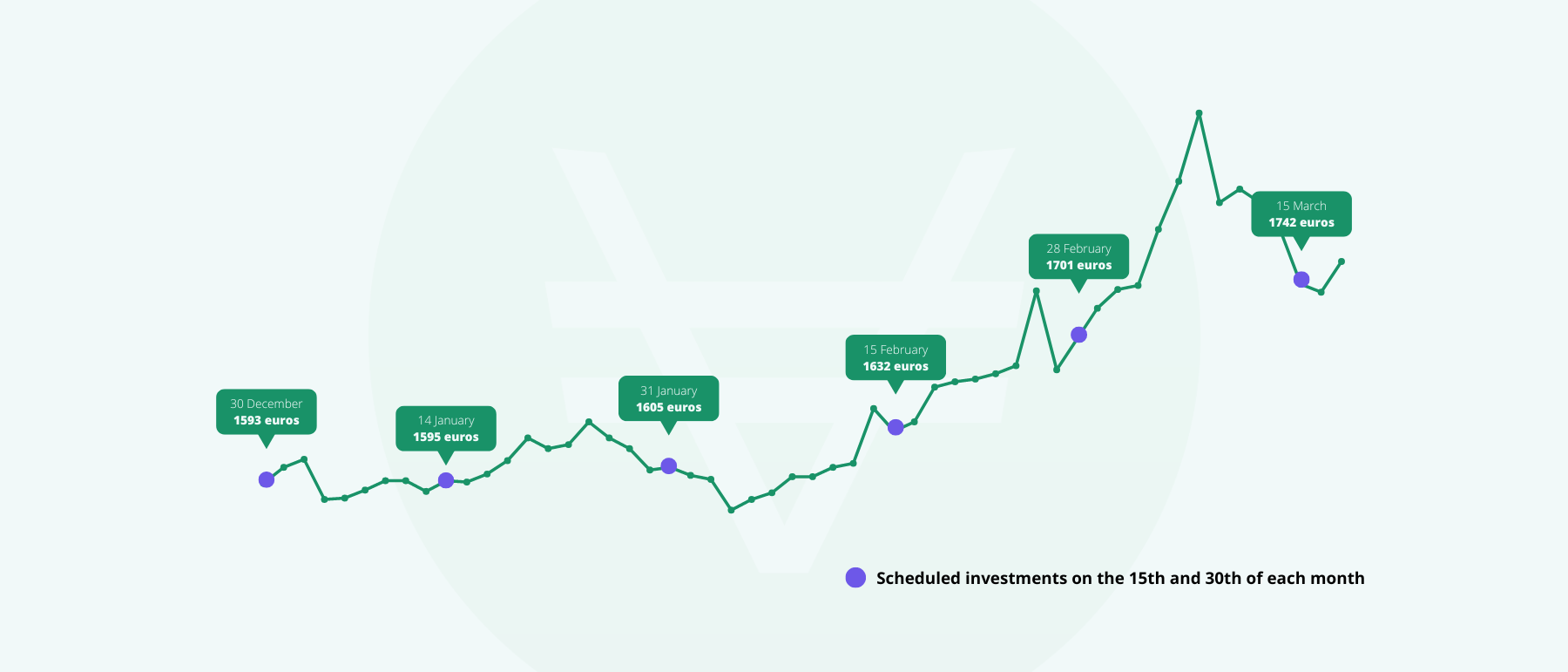

DCA or the smart art of buying gold

The health crisis of the last two years and the current geopolitical turmoil over the war in Ukraine have once again demonstrated that gold is a safe…

21 February 2023

Could inflation be both the problem and the solution?

Rising prices are undoubtedly the indicator that speaks loudest to the most people. Depending on geographic location and position in the economic…